Case of any discrepancy in the application and/or for receiving PAN through e-mail. (3) Application status updates are sent using the SMS facility on the mobile numbers mentioned in the application form. (a) Form to be filled legibly in BLOCK LETTERS and preferably in BLACK INK. Process The signed form with the requisite documents should reach the designated address within 15 days of the online appli cation. If the payment mode is demand draft, the PAN card is issued on realisation of the payment, and dispatched to the communication address mentioned by the applicant.

Permanent Account number consists of a 10-digit number allotted by the Income Tax Department of India under the supervision of the Central Board of Direct Taxes. For every individual, it is mandated to have a PAN Card even Non-Resident Indians are also required to have a PAN Card.

Why PAN Card for NRIs?

- If NRI is earning a taxable income in India

- If NRI wants to do trading in shares, through broker or depository.

- If NRI wants to invest in Mutual funds.

- If NRI is looking to purchase land or any property in India

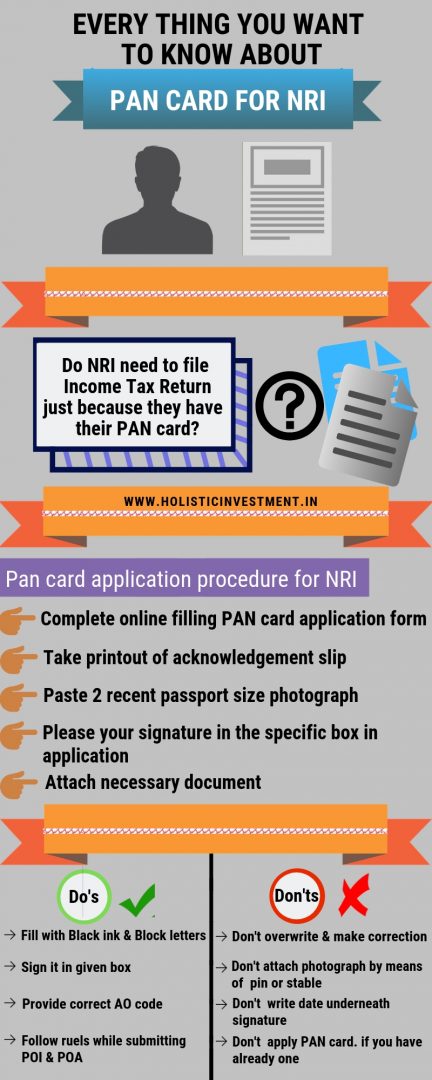

Process to apply PAN card for NRIs

- All those people who are holding Indian Citizenship and settled abroad should fill form 49A to apply for PAN Card application. NRIs who hold Foreign citizenship such as OCI holders or people who have originated from India but have Foreign citizenship should fill form 49AA.

- After filling either form 49 A or 49 AA, the confirmation screen would be appearing. All information which is filled in the form should be properly checked and verified before doing the submission. If the form requires editing of any information, one can edit and after that can-do resubmission of form. You will get an online acknowledgment receipt containing a 15-digit number. Take at least 1 print of it.

- In the space provided in the acknowledgment, affixed 2 recent passport size photographs.

- One needs to be sure to use a black ink pen to do signature and always make use of left thumb impressions. There is a specific box provided, it should be done in that only to avoid any kind of rejection.

- Applicant needs to do attachment of all the necessary duly attested documents which include identity proof like Aadhar Card, driving license, voter ID Card, copy of passport, copy of NRE bank statement, copy of bank account, 2 colored photographs with black and white background. If the mode of payment is Demand Draft, then it is also part of documents that need to be attached.

- After form submission, one gets an acknowledgment number which is used to track the status of the PAN Card application.

- The processing fee is Rs 110 inclusive of GST taxes if the communication address is within India. Payment can be made using any mode such as Debit Card, Credit Card, Demand Draft, Net Banking. One must keep in mind that the demand draft should be drawn in favor of NSDL-PAN, payable at Mumbai. For payment, Foreign Credit Cards are not accepted.

- The processing fee for applicants whose communication address is outside India is Rs 1020 which consists of PAN application fees, postage, and Tax. Service of PAN Card application is available for 105 countries and the list is available on the website of NSDL https://tin.tin.nsdl.com/pan/Country.html.

Income Tax PAN Services Unit,

National Securities Depository Limited,

3rd floor, Sapphire Chambers,

Telephone Exchange, Baner, Pune – 411045

- The Title of the envelope should be in this format: ‘APPLICATION FOR PAN- Acknowledgment Number’ (e.g. ‘APPLICATION FOR PAN- 981000100100123’).

- The acknowledgment, DD (if any) and proofs shall reach NSDL within 15 days from the date of making an online application.

Things to do while filling an Online PAN application are:

- Offline PAN application should be filled only with black ink with clear BLOCK letters.

- Signatures need to be done in the provided box only and not across the photograph.

- AO code should be correctly mentioned in the PAN application form.

- Following rules to be followed at the time of providing Identity proof and address proof.

- Please make sure that the information provided in the PAN application should be the same as being mentioned in supportive documents.

- If the person applying for PAN is a minor, then POA and POI are also required to be deposited by his/her representative.

Things to avoid while filling the PAN Card application for NRIs

How To Apply Pan For Nri

- It is advisable to avoid overwriting and doing corrections in the given application.

- Do not staple or pinned photographs. Try to get it attached by way of sticking it to the application.

- While signing the application, there is no need not to write date and place underneath your signatures.

- Do not state the husband’s name in the father’s name column.

- Do not apply for the PAN card, if you already possess one.

How To Apply Pan Card Online For Nri

| Proof of Identity | Proof of Address |

|---|---|

| 1. Copy of Certificate of Registration issued in the country where the applicant is located, duly attested by “Apostille” (in respect of the countries which are signatories to the Hague Convention of 1961) or by the Indian Embassy or High Commission or Consulate in the country where the applicant is located or authorised officials of overseas branches of Scheduled Banks registered in India (in prescribed format) . ; or | 1. Copy of Certificate of Registration issued in the country where the applicant is located, duly attested by “Apostille” (in respect of the countries which are signatories to the Hague Convention of 1961) or by the Indian Embassy or High Commission or Consulate in the country where the applicant is located or authorised officials of overseas branches of Scheduled Banks registered in India (in prescribed format) . ; or |

| 2. Copy of registration certificate issued in India or of approval granted to set up office in India by Indian Authorities. | 2. Copy of registration certificate issued in India or of approval granted to set up office in India by Indian Authorities. |